In M&A operations, domestic and foreign companies seek to expand their business, with the expectation of gains in business synergy, meaning, therefore, the means to make their inorganic growth viable. As will be better detailed below, it is a transaction that requires expertise in negotiation techniques, participation not only of legal professionals, but also of accounting and financial authors, application of protection mechanisms (both buy side and sell side), always with the objective of equipping the parties involved in the operation with tools and structures essential for the best decision making, thus minimizing adversity, and facilitating the intercompany integration plan.

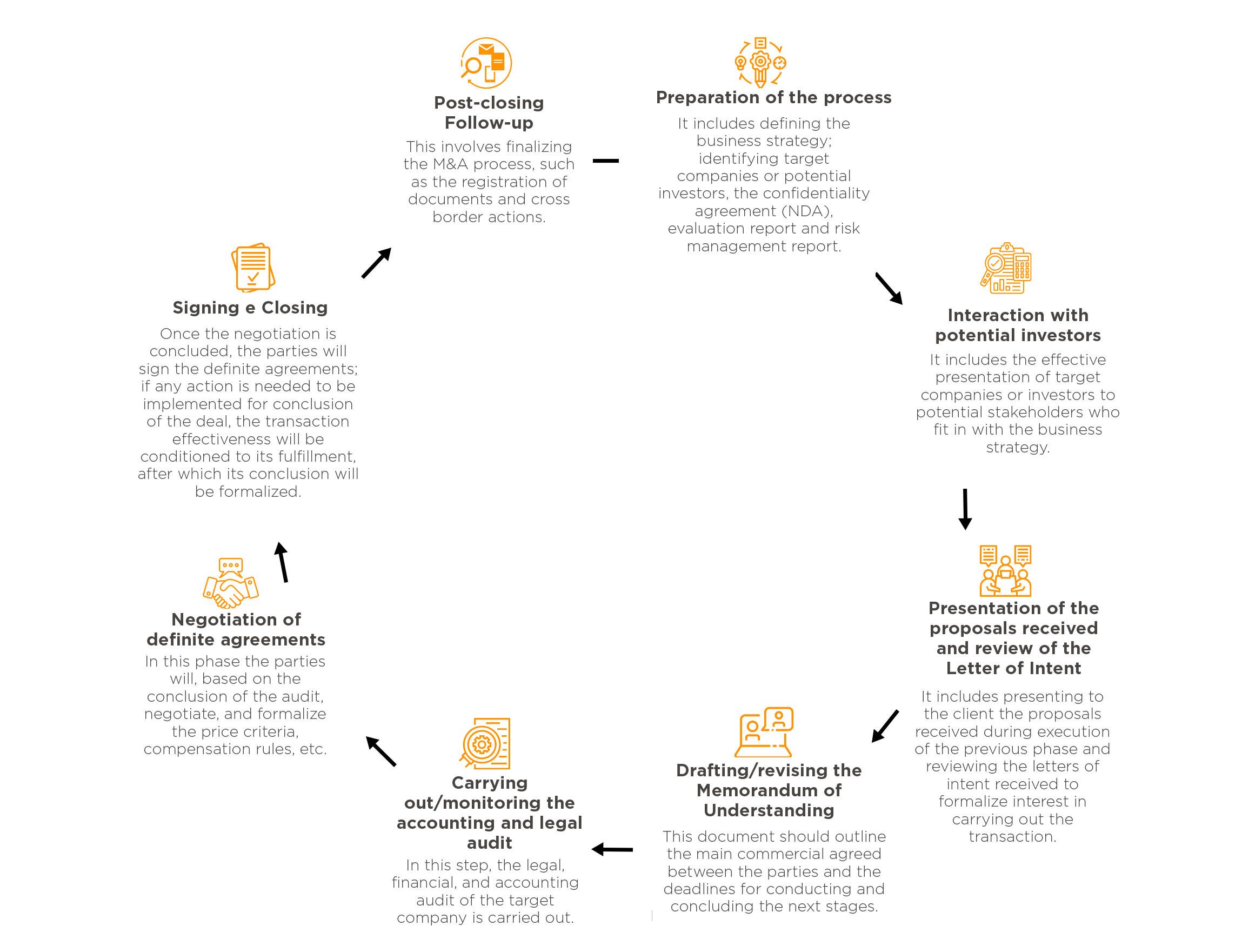

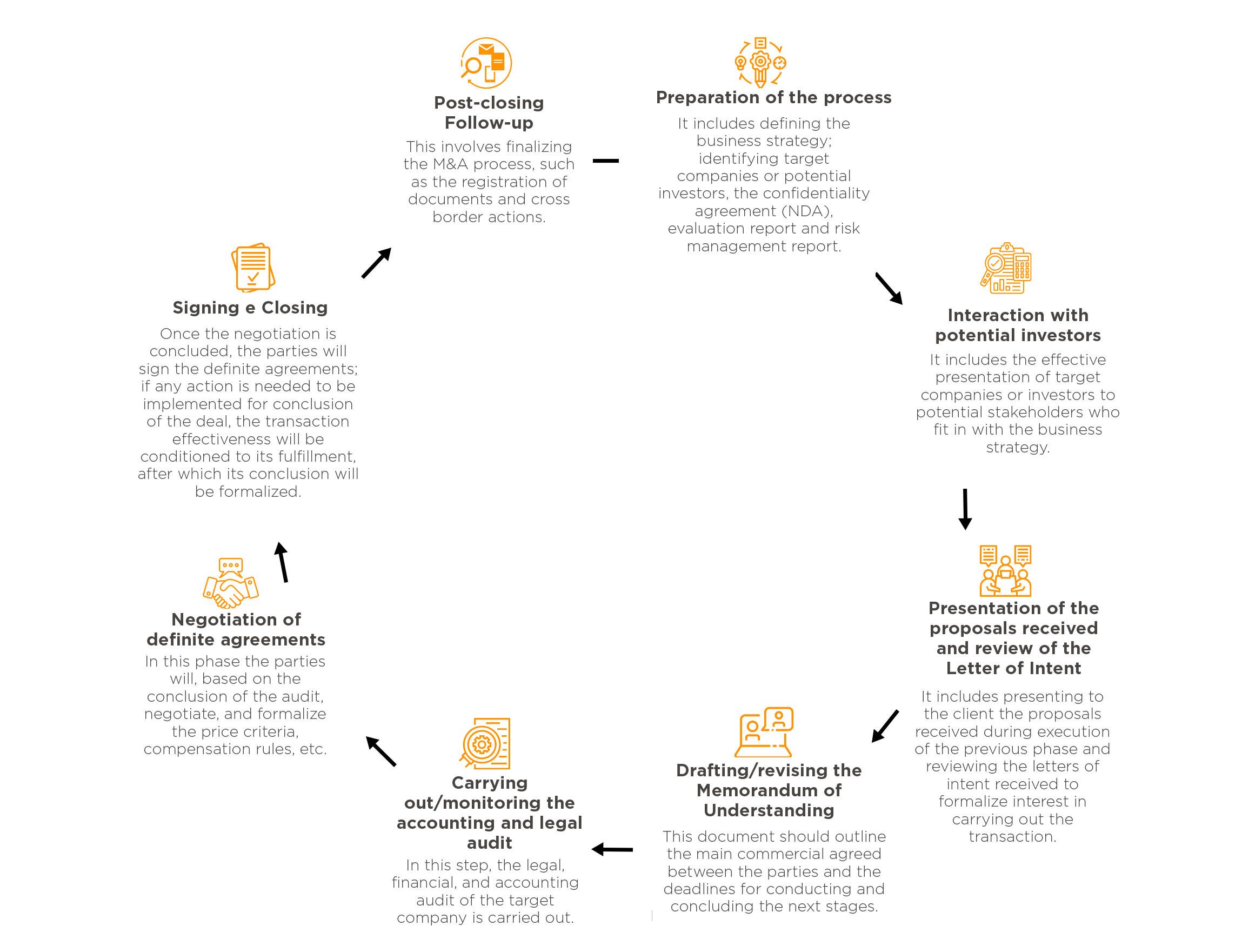

We can summarize an M&A operation by considering the following steps:

Thus, in the first stage, the concept of preparation of the process includes the need for the interested party to meet with their financial advisor to define and outline the strategy of the intended business, which includes carrying out the evaluation of the business, raising possible risks of the action (risk management) and evaluating means of carrying out the operation, identifying the profile of the target companies (buy side view) or potential investors/buyer (sell side view). That is, it seeks to define the reason for aiming for a business synergy or for intending to leave a certain branch of business and sell it to a potential buyer, as the case may be. It is important to say that the analysis must be careful to find buyers or sellers in fact aligned with the interests of the company, such as funds with theses with which there are synergies, or companies that are part of the same market with the objective of making strategic transactions.

In order to protect the information that will be exchanged in the next stage, of a financial or commercial nature, such as customer and supplier portfolios and data that evidence the financial reality of the company, among others, a confidentiality agreement (Non-Disclosure Agreement “NDA”) is prepared.

In the second stage, the interaction with potential investors begins, a procedure through which the target company or potential investors, as the case may be, are presented to potential stakeholders, whose profile was outlined in the previous stage.

The next act, in the third stage, occurs the presentation to the client of the proposals received by the interested parties mapped in the previous stage, which occurs through a Letter of Intent formalizing the interest in proceeding to the next stage (without binding effects).

In the fourth stage, once the client has defined whether the Letter of Intent received makes sense to achieve its objective, the parties then proceed to negotiate the Memorandum of Understanding (“MoU”), through which the main commercial conditions of the transaction and the deadlines for conducting and completing the following steps are formalized, in principle and commonly, still no binding effects.

Once the MoU is signed, the fifth stage begins, through which the current photograph of the target company is thoroughly investigated, through the performance of a legal, accounting, and financial due diligence (“Due Diligence”) focused, at first, on corporate acts and practices, financial statements, contracts signed with suppliers and customers, employment contracts, loans and financing contracted, judicial and administrative proceedings perhaps in progress, compliance with legal obligations.

Due Diligence is of high relevance, because it identifies the eventual risks of the business, quantifies any liabilities that may impact the negotiation (whether in the labor, tax, compliance, anti-corruption, civil, environmental, corporate, among others). It is also undeniable that it is expected to frame, regardless of its sector of operation, sustainable and responsible practices under the environmental, social and governance bias, thus ensuring its longevity and consumer adherence. An unsatisfactory result of Due Diligence may indicate operational, legal, and reputational risks, negatively affecting the company’s valuation. On the other hand, a company with positive results can bring competitive advantages to the negotiation.

Once the Due Diligence has been completed, and based on its result, there is an interest in proceeding (assuming that the MoU was signed without binding effects), the parties begin the sixth stage, which consists of negotiating the definitive contracts of the transaction. Here the parties will define and formalize the price criteria, any guarantees that may be necessary to cover any liabilities, indemnification rules, governance rules (as applicable), among others, which shall be reflected in the definitive contract(s) of the transaction.

It is important to mention that, depending on the structure of the operation, the definitive agreements may vary, consisting of (i) contract of purchase and sale of shares / shares (QPA / SPA) or investment agreement; (ii) partners/shareholders’ agreement (if the seller remains a minority shareholder in the target company in order to ensure governance rules); (iii) employment contract (if the seller remains working at the target company); (iv) guarantee agreements, both to ensure the payment of the price (sell side) and the indemnity (buy side); among others.

In addition, there will be a clause in the QPA/SPA or investment agreement, as applicable, called Representations and Warranties, through which the seller must attest to the photograph of the target company, as mapped out in the Due Diligence. This clause is extremely relevant, in that, if a false declaration occurs, the seller will be subject to significant compensation, also provided for in the QPA/SPA or in the investment agreement.

By way of example, the following are the procedures adopted in the QPA/SPA or investment agreement, linked to the guarantee, among others, as the case may be:

- Holdback;

- Escrow;

- Fiduciary disposal of shares.

Likewise, it is possible to provide in the QPA/SPA or in the investment agreement the following rules linked to compensation, among others, as applicable:

- De minimis Clause;

- Basket Clause;

- Cap.

In the shareholders/shareholders’ agreement, it is possible to negotiate to include governance clauses such as the following, among others, depending on the format of the transaction:

- Lock Up;

- Tail clause;

- Right of First Offer;

- Right of Pre-emption;

- Tag Along;

- Drag Along;

- Non-Competition; Non-grooming.

After the previous stage, the parties sign the definitive contract(s) that were, until then, under negotiation (Signing) and, with actions to be implemented after the signature and before the effective conclusion of the operation (Closing) (regulatory, contractual, corporate reorganization, etc.)., define, in the signed contract, what we call the Precedent Conditions, which must be fully fulfilled in the period between the Signing and the Closing, which consists of the seventh stage.

As an example of a Precedent Condition is the approval of CADE when it comes to large M&A operations, in order to verify compliance with the requirements of the Law for the Defense of Free Competition / Antitrust Law (Law 12.529/2011), demonstrating that the intended transaction will not generate a monopoly.

The eighth stage intends to deal with the post-closing follow-up of the transaction, dedicated to the actions that are necessary to make the transaction public/known to third parties, as applicable, such as registrations and cross-border actions.

Finally, considering that the M&A operation has already been structured, dealing with a foreign buyer, it is important to note that in Brazil there are specific rules and procedures that must be complied with before the Central Bank of Brazil (BACEN), such as the registrations of capital of foreign origin (RDE-IED) and financial operations (ROF). Also, depending on the corporate model adopted for the constitution of the local investment, it is necessary to identify whether there is an international agreement or convention to avoid double taxation between the country of origin of the acquirer and Brazil in order to reduce the tax burden on the operations practiced.